Limited liability company (LLC) - Internal Revenue Service

Oct 9, 2025 · Review information about a Limited Liability Company (LLC) and the federal tax classification process.

Get an employer identification number | Internal Revenue Service

Aug 8, 2025 · If you are forming a legal entity (LLC, partnership, corporation or tax exempt organization), form your entity through your state before you apply for an EIN. If you don’t form …

Employer identification number | Internal Revenue Service

Jul 31, 2025 · Form your entity first: If you’re creating a legal entity (LLC, partnership, corporation), register it with your state before you apply for an EIN. This includes tax exempt …

About Form W-9, Request for Taxpayer Identification Number and ...

Sep 5, 2025 · Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, including recent updates, related forms, and instructions on how to file. Form W-9 …

Instructions for Forms 1099-MISC and 1099-NEC (04/2025)

Generally, payments to a corporation (including a limited liability company (LLC) that is treated as a C or S corporation). However, see Reportable payments to corporations , earlier.

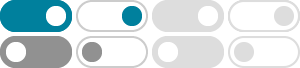

An LLC that is a disregarded entity should check the appropriate box for the tax classification of its owner. Otherwise, it should check the “LLC” box and enter its appropriate tax classification.

Single member limited liability companies | Internal Revenue Service

Review information about the Limited Liability Company (LLC) structure and the entity classification rules related to filing as a single-member limited liability company.

Starting a business - Internal Revenue Service

Jul 17, 2025 · Find federal tax information for people starting a business, and information to assist in making basic business decisions.

S corporations - Internal Revenue Service

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations …

When to get a new EIN - Internal Revenue Service

Nov 21, 2025 · Sole proprietors Corporations (including tax-exempt organizations) Partnerships Limited liability company (LLC) Estates Trusts